Background

The International Monetary Fund (IMF), in its 2024 report, recognised India’s Pradhan Mantri MUDRA Yojana (PMMY) as a key pillar of grassroots financial inclusion and entrepreneurship through credit. Launched on April 8, 2015, by Prime Minister Narendra Modi, this visionary scheme has not only unlocked credit for millions but has also nurtured a culture of self-reliance. This step echoes the ideal of Swa, where the last in the social strata is empowered to shape his or her destiny. The creation of MUDRA (Micro Units Development & Refinance Agency Ltd.) marked a turning point in India’s financial history. It was established to offer financial support to non-corporate, non-farm small/micro enterprises through banks, NBFCs, MFIs, and other last-mile financial institutions. Introductory Memo

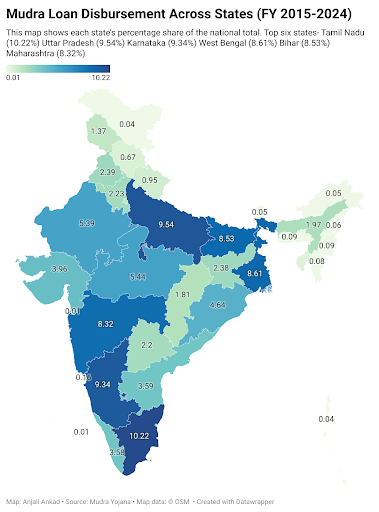

Ten years on, PMMY has evolved from a policy initiative into a silent revolution, disbursing more than Rs 33 lakh crore in collateral-free loans and enabling more than 52 crore entrepreneurial journeys. These figures go beyond statistics; they signify the livelihoods rebuilt, aspirations uplifted, and a deeper transformation of India's economic fabric from the bottom up. With an enabling policy framework and active programme monitoring, MUDRA continues to bridge the gap between ambition and access.

The PMMY recognised a long-ignored truth: that the poor, women, small traders, artisans, and daily-wage entrepreneurs possess a natural entrepreneurial spirit but lack access to formal credit.

PM Modi put it succinctly:

“When people did not even have access to basic banking, funding for

entrepreneurship looked like a distant dream.”

Thus, a holistic approach was implemented:

PMMY in Numbers

a. As of FY25, the gross non-performing assets (NPAs) under PMMY declined to 2.21% overall, according to DFS Secretary M Nagaraju (April 7, 2025).

b. Public Sector Banks (PSBs) reported a slightly higher average NPA of 3.6%, while private lenders, NBFCs, and MFIs performed better in recovery.

This highlights that with its tiered loan structure (Shishu, Kishor, and Tarun), MUDRA ensures that micro-entrepreneurs — especially from marginalised communities such as SC/ST/OBC, women, and minorities — are not just included but prioritised in the growth journey.

Moreover, MUDRA does not displace people from their traditional occupations; it modernises and strengthens them. A weaver continues to weave, but now with improved tools and better access to markets. A street vendor upgrades his cart into a permanent shop.

Catalysing MSME Growth

According to a recent SBI report, the credit flow to Micro, Small, and Medium Enterprises (MSMEs) has witnessed a remarkable upswing, significantly influenced by the success of the MUDRA Yojana. MSME lending has grown sharply — from Rs 8.51 lakh crore in FY14 to Rs 27.25 lakh crore by FY24 — and is expected to surpass Rs 30 lakh crore in FY25. During the same period, the share of MSME credit in the overall bank lending portfolio rose from 15.8% to nearly 20%, highlighting the increasing importance of small businesses in India’s economic landscape.

This growth has opened new avenues of financial access for entrepreneurs in rural and semi-urban areas — segments that had long remained marginalised. By enabling credit, this expansion has played a key role in building a self-reliant economy and fueling employment at the grassroots level.

From Shishu to Tarun

What began as a push for micro-level enterprises is now showing clear signs of evolution. The proportion of Kishor loans — ranging between Rs50,000 and Rs five lakh — has surged from just 5.9% in FY16 to nearly 44.7% by FY25. This growth signals a transition, as many micro-enterprises move towards becoming small businesses.

Similarly, the Tarun category (Rs 5 lakh to Rs 10 lakh) is steadily gaining traction, demonstrating that MUDRA is not merely a launchpad for new ventures but also a growth engine for businesses looking to expand. The data points to one thing: Enterprises can start small but dream big.

As MUDRA Yojana completed a decade, its true success lies not just in loans sanctioned but in the silent transformation it has enabled — where self-reliance is no longer a slogan but a lived reality for millions. It stands as a symbol of inclusive growth, grassroots empowerment, and the government’s commitment to mainstreaming every Indian with a dream.

Compiled by MHKC

_202504081832480852_H@@IGHT_338_W@@IDTH_410.jpg)